How To Choose The Right Biological Wastewater Treatment System

Biological treatment systems should be designed around every individual application to specifically target and treat pollutants produced by different industries and sectors. This is why it is crucial to choose the right treatment process for the secondary treatment of wastewater.

When choosing the right method for treating wastewater, there are a lot of options to choose from. Secondary stages consist of biological water treatment systems and have different options. Making the right considerations of multiple aspects is necessary to choose the best solution for your application.

There are some considerations at the core of biological treatment. The general considerations to make include construction costs, occupied area and operation costs.

The specific considerations to make are the sludge retention time and the hydraulic retention time. The hydraulic retention time is how long the effluent will be exposed to the process while the sludge retention time is the time that a unit of sludge is active within a reactor.

Treatment design and selection of biological wastewater treatment systems take all of the above criteria into consideration. During the decision-making process, it is important to give weight values to each criterion and give points to each method. The points should then be multiplied by the weights and the final results should be used to compare every option. The weighting system is subject to change based on the criteria a municipal organization or a company deems important so we will not go into more details.

The characterisations of your facility

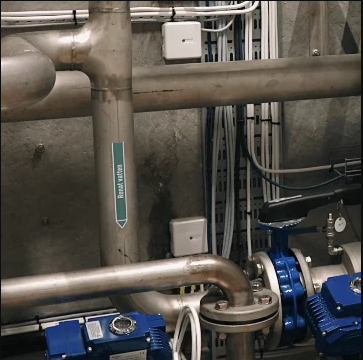

When choosing biological treatment platforms and systems for your facility, it is crucial to consider the characterisations of your facility. The equipment that will go into the makeup of the system is one of the top factors that determine the best treatment system for your facility. You should consider whether the plant processes food that leaves behind wastewater heavy in oils, BOD, and grease.

Does the process of the facility include metal manufacturing that contaminates the wastewater with suspended metals such as iron, zinc, lead and nickel? Does the wastewater have high inorganic contaminant levels? These are some of the top questions you need to ask yourself when choosing a treatment system. These factors will determine the type of treatment system for your facility.

Consider the regulatory requirements

Another important factor you need to consider when choosing a treatment facility is the regulatory requirement for discharge. When handling wastewater, what your facility does with water is a key determinant in choosing the right technologies to treat the wastewater.

Releasing wastewater into the environment

If you want to release your wastewater into the environment then you need to get the necessary permits and ensure the water is fit to be released into the environment. Your local regulations will determine the right treatment method for your facility.

Discharging water into the municipality

You can discharge your water into your local municipality but you have to treat it using the right biological treatment systems. Check with your municipality to be sure you are using the right systems and meeting their requirements.