High Return On Savings In Axis Small-Cap Fund

It is an open-ended equity scheme that invests primarily in small-cap stocks. Generate long-term capital appreciation mostly from a diversified portfolio of small-cap companies, mainly equity and equity-related instruments.

Axis Small Cap Fund Direct Growth is an equity mutual fund scheme from Axis mutual funds. The scheme was launched on 29 November 2013 and is currently operated by its fund manager Anupam Tiwari. It has an AUM of ₹2,084.44 crore, and the latest NAV is ₹37.720 as of 14 Feb 2020.

Axis small-cap fund direct growth fund details:

- Category Equity: Small Cap

- Asset Under Management-₹2,084.44 Cr

- Expense Ratio-1.98%

- Fund Manager-Anupam Tiwari

- Minimum investment – Rs. 5,000.00

- Launch Date- 29 Nov 2013

- Fund Type- Open-End

Axis small-cap fund direct growth fund %

- 87.54% investment in Indian stocks

- 14.28% is in mid-cap stocks

- 66.99% in small-cap stocks

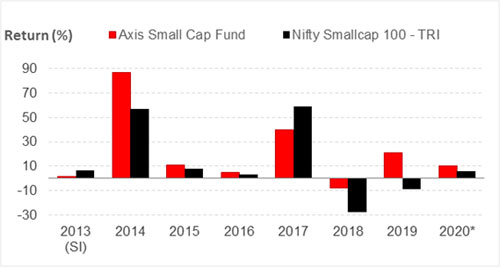

Axis Small Cap Fund Direct-Growth scheme return performance

- 38.83% in one year

- 58.42% in last three years

- 276.82% since the scheme launch

- The SIP amount to invest- ₹1000

Axis small-cap fund direct growth fund – Exit load information

If you redeem units before one year, 1% Exit loads for remaining investments and nil for 10% of investments.

If you redeem units after one year, then the exit load is Nil.

Applicability of investing in Axis Small-Cap Fund Direct-Growth Fund

Investors who want to invest money for at least 3-4 years and are looking for very high returns. Also, these investors should also be prepared for the possibility of higher losses in their investments.

When you invest for seven years or longer, you can expect gains that beat the inflation rate comfortably and are higher than fixed income options.

It is a fund that invests in small companies. When stock prices fall, such funds tend to fall more than those investing in large companies. So you can expect higher-term returns, but more severe fluctuations along the way.

As you do with all equity funds, you only have to invest through the SIP path.

Taxation of Income: Capital gains

- If an investor sold his mutual fund units after one year from the date of the start of the investment, if you earn up to Rs 1 lakh in your financial year, then this amount will be exempt from tax. If you get more than Rs 1 lakh, then this amount will be taxed at a rate of 10%.

- If you are selling your mutual fund unit within one year from the beginning of the date of investment, then any amount you get will be taxed at the rate of 15%.

- As long as you continue to operate the units, there will be no tax.

Dividends

Dividends paid through mutual fund schemes are taxed at the rate of 10% (actually 11.648%, including surcharges and cess). Although this tax is not paid directly by the investor, it is subtracted from the dividend revenue before it is given to the investor.