How To Trade Triangle Patterns In Forex Like A Pro

Triangle patterns are among the most reliable and commonly used chart patterns in forex trading. These patterns form when the price consolidates between two converging trend lines, creating a triangle shape on the chart. They are known for their potential to indicate impending price breakouts, providing traders with profitable trading opportunities. This article will explore how to trade triangle patterns in forex like a pro effectively.

Understanding Triangle Patterns

Before diving into trading triangle patterns, it’s essential to understand their different types. There are three primary types of triangles:

Symmetrical Triangle

This pattern occurs when the price consolidates within two converging trend lines. The upper trend line connects lower highs, while the lower trend line connects higher lows. The symmetrical triangle represents indecision in the market as buyers and sellers battle for control. It suggests that a breakout is imminent.

Ascending Triangle

An ascending triangle is formed when the price consolidates between a horizontal resistance level and an upward-sloping trend line. The flat resistance level is a psychological barrier, while the ascending trend line indicates increasing buying pressure. This pattern often results in a bullish breakout.

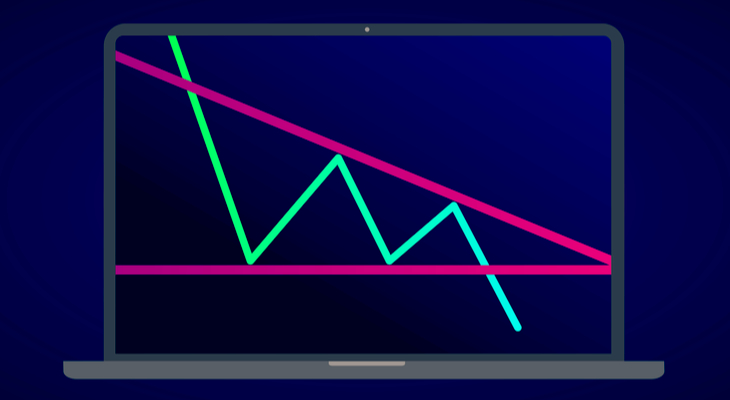

Descending Triangle

On the other hand, a descending triangle takes shape when the price stays within a horizontal support level and a trend line that slopes downwards. The flat support level is a psychological barrier, while the descending trend line indicates increasing selling pressure. This pattern often leads to a bearish breakout.

Identifying Triangle Patterns

To trade triangle patterns effectively, traders must first learn to identify them accurately. Here are some critical steps to identify triangle patterns:

Draw trend lines

Draw trend lines connecting the swing highs and swing lows within the consolidation area. Ensure that the lines converge to form a triangle shape. Remember, having at least two touchpoints on each trend line is crucial for confirmation.

Confirm pattern

After drawing the trend lines, confirm the pattern’s validity. Look for price bounces off the trend lines and subsequent reversals within the triangle. The more touchpoints the price has with the trend lines, the stronger the pattern becomes.

Measure breakout potential

Determine the potential breakout direction by observing the slope of the triangle’s trend lines. A steeper trend line suggests a higher probability of a strong breakout.

Volume analysis

Analyse volume during the consolidation period. Generally, volume tends to decrease as the triangle pattern develops. However, a significant surge in importance during the breakout can validate the way and increase the probability of a successful trade.

Trading Triangle Patterns

Now that we understand how to identify triangle patterns let’s explore some effective trading strategies:

Risk Management

Risk management is of utmost importance when trading triangle patterns in forex. To mitigate potential losses, it is essential to implement proper risk management strategies.

One crucial aspect is using appropriate position sizing, which allows you to control potential losses and align them with your risk tolerance. Additionally, it is essential not to rely solely on triangle patterns for trading decisions.

Remember, the goal is to become a proficient trader capable of identifying profitable opportunities. Once you have mastered these skills, you can confidently choose among the top rated forex brokers to execute your trades precisely.

Breakout Strategy

The most common strategy when trading triangle patterns is to wait for a breakout. A potential trade opportunity arises once the price breaks above the upper trend line (in a symmetrical or ascending triangle) or below the lower trend line (in a balanced or descending triangle).

Here’s how to approach this strategy:

Entry: Enter the trade after the breakout occurs, and the candlestick closes above the upper trend line or below the lower trend line. This confirms the validity of the breakout.

Stop-loss: Set a stop-loss order just below the breakout point (in case of a bullish breakout) or above the breakout point (in case of a bearish breakout). Limiting potential losses is possible by using this strategy in case the breakout fails.

Take-profit: Calculate the target price level by measuring the height of the triangle pattern and projecting it in the breakout direction. This can provide a rough estimate of the potential profit target.

Pullback Strategy

Another strategy to trade triangle patterns is to wait for a pullback after the breakout. This approach takes advantage of price retracements, potentially providing better entry points.

Here’s how to implement this strategy:

Entry: Wait for the price to retest the breakout level after the initial breakout. Look for a candlestick pattern that indicates a potential reversal, such as a bullish/bearish engulfing pattern or a hammer/shooting star. Enter the trade when the price shows signs of bouncing off the breakout level.

Stop-loss: Set the stop-loss order below the swing low (in case of a bullish breakout) or above the swing high (in case of a bearish breakout) formed during the pullback. This protects the trade in case the price reverses.

Take-profit: Use the same method as the breakout strategy to determine the potential profit target based on the height of the triangle pattern.

Conclusion

Trading triangle patterns in forex require patience, discipline, and a systematic approach. By accurately identifying these patterns and implementing effective trading strategies, you can improve your chances of profiting from the potential breakouts they offer. Remember to manage risk and adapt your trading plan based on market conditions. With time and practice, you can trade triangle patterns like a pro and enhance your forex trading skills.